As much as it gives comfort and peace of mind, achieving financial freedom might not be that easy. Managing your finances, paying bills, allocating your income, improving cash flow, and even choosing and managing your investment can be often confusing and stressful.

But the good thing is that technology has lead to having more and more apps to help us in almost everything, including our personal financial management.

There are a variety of finance apps and some of them attend to specific needs like day-to-day budgeting, managing investments, saving, eliminating debts, and more.

The best finance apps that you can have on your mobile phone

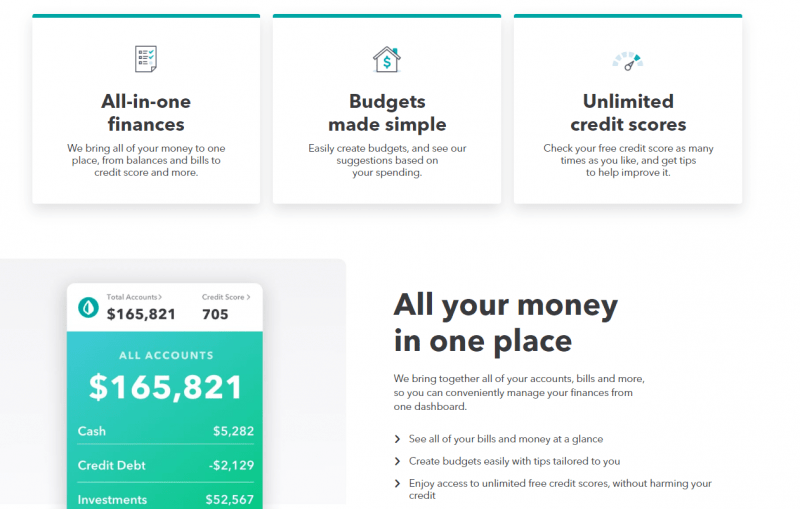

Mint

Mint is a financial tracker and money manager app that serves as an all-in-one platform for balance, bills, and even credit scores. With Mint, you can conveniently connect your bank and credit card accounts as well as your bills so you can manage everything in one place.

It automatically updates and categorizes information and syncs everything to give you an accurate overview of your budget and how you can stretch it further. Mint also provides tailored tips for your budget.

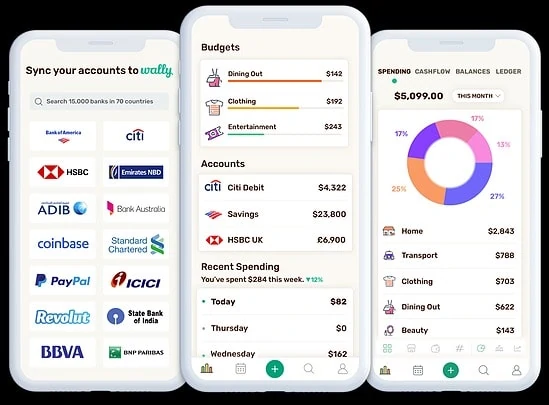

Wally

Wally is an efficient app mainly for tracking your expenses. It also centralizes accounts and then helps you understand, manage, and improve your finances. With the free app, you can set your budget that suits your needs, record expenses by simply taking a photo of your receipt, budget by category on a day-to-day basis, and track your progress on how were you spending and saving in the long run.

Wally is available only from the App Store for iOS.

If you’re looking for that app to help you create your personal expense report and encourage you to improve your finances, Wally can be your best choice.

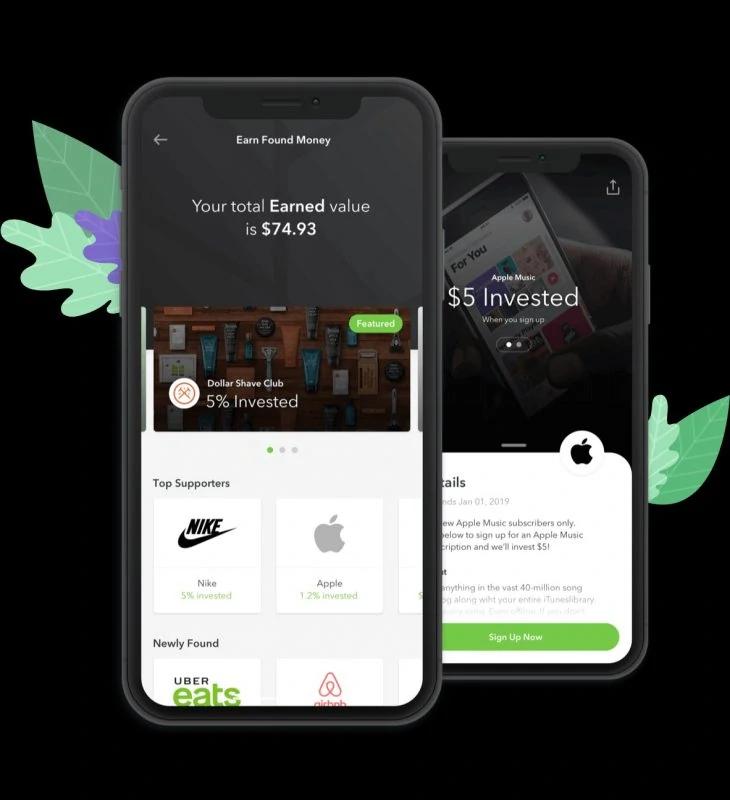

Acorns

For the future-forward thinkers and those who really aim to save for the rainy days and even for their retirement, the finance app Acorns will work great. The Acorn app empowers users to manage and monitor their expenses and then invest spare change that they may have.

It also offers easy, automated retirement accounts and provides advice and insights from financial experts.

Worth reading: The best apps for your iPhone

You Need a Budget

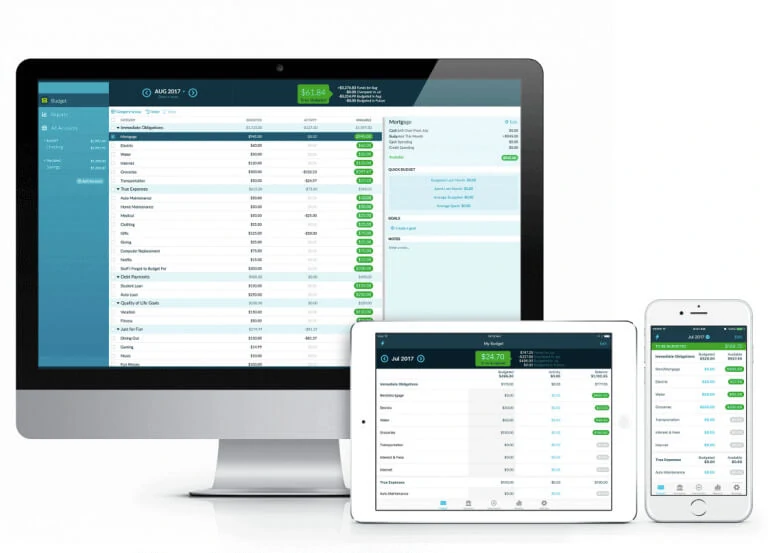

If you’re struggling with debt or on the verge of doing so, YNAB or You Need a Budget might be able to help you. YNAB does not promise to make financial management easier for you but rather smarter.

No promises of effortless savings, instead, YNAB will encourage you to manage your budget in a way that you will be able to pay up your debts by helping you prioritize and plan your spending with every dollar.

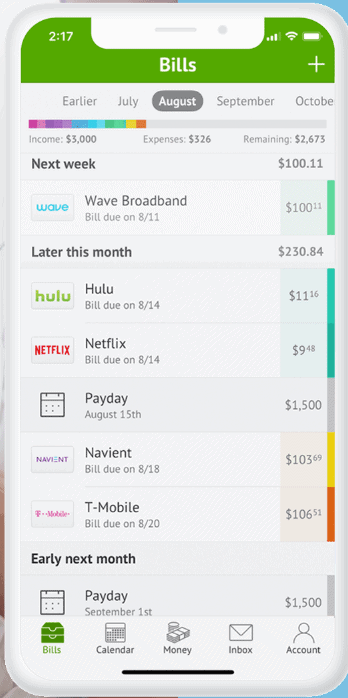

Prism

Bills and due dates are crucial and stressful. If managing and settling your bills drains the energy out of you, Prism can be a very helpful app. This free application tracks your bill and automatically alerts you when it’s almost due. It also provides an overview of your income, account balances, and expenses for the month to help you manage your finances better.

Prism helps you gain that peace of mind to not miss any bill due dates and takes away the hassle of worrying and checking your mailbox, e-mail, message inbox, and other websites to see if your bill is due.

Empower

Empower is another finance managing app that combines budgeting and savin, serving as an expert financial coach that you can carry around with you. It has features like Automated Saving that lets you set a savings target and helps you achieve it effortlessly. Empower also allows access to human financial coach and offers proactive tips to help you spend and save better.

Empower is available for both iOS and Android.

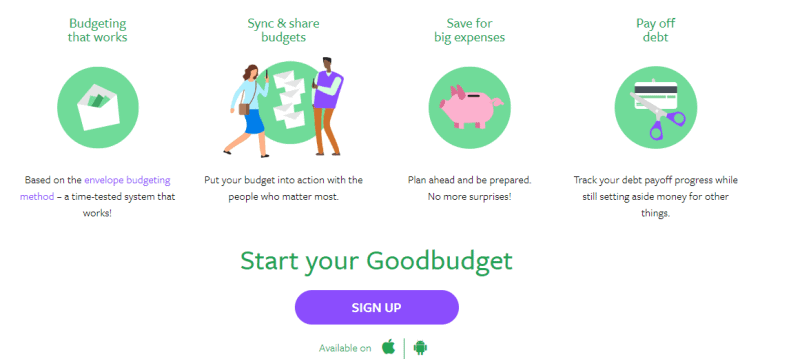

Goodbudget

Do you still want to stick to the traditional approach? Goodbudget will give you just the digitized version of the classic yet proven envelope system for your budgeting. Suitable for managing your home budget, the Goodbudget app will also allow you to share your budget with your family, housemates, or whoever you share your expenses with.

The app also helps prepare and save up step-by-step for big expenses as well as paying debts. Primarily, the app reduces the risk of being caught off-guard for every bill and sudden expenses as it is designed to let users set aside a budget for everything each cut-off or payout.

Goodbudget is avalable for both platforms, iOS and Android.

Clarity Money

Clarity Money is an efficient free app that utilizes machine learning to analyze finances and provide insights to empower better and smarter financial decisions. Through the app, you can easily organize your bills and track your budget, spending, savings, debt and investment accounts. It also lets users save automatically with their Marcus Online Savings Account.

More importantly, if you are one of those who have been hooked in today’s subscription-based living, Clarity Money can help you monitor those subscriptions and cancel them when you no longer need them.

Personal Capital

You almost have that financial freedom with a budget for everything, flourishing savings, and a couple of investments in the market yet still challenged to manage everything simultaneously. Well, Personal Capital, a free money management app might be the one for you.

It has a complete feature for managing all your accounts in a single dashboard as well as planning your retirement. Best of all, it also helps you manage all your investment accounts and utilize its built-in investment intelligence for comparing your portfolio’s allocation to the recommended target allocation.

It can help you not just in your budget management but even in making better investment decisions.

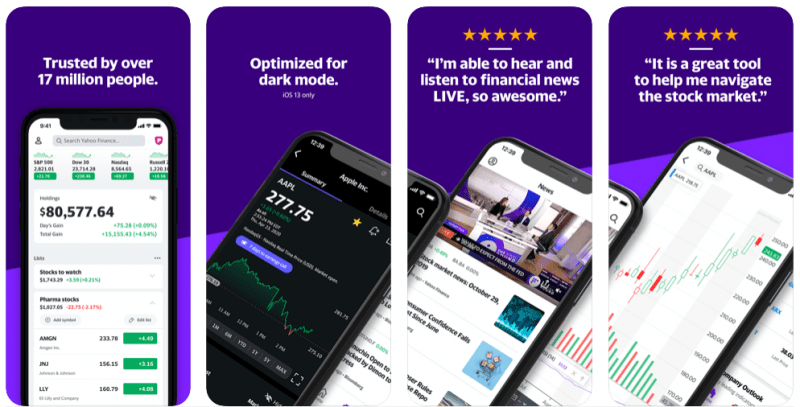

Yahoo Finance for Android and IOS

If you need more than budgeting, spending, or saving and has advanced into the further phase of financial management such as investing, Yahoo Finance will come handy. One of the reliable sources for financial news updates, Yahoo, has created an app that gives you access to relevant information regarding the financial markets.

With their interactive app, you can follow the stocks that you need to watch out for, track information on your personal portfolio, get notified for the latest economic news, price alerts, investment opportunities, and get the relevant information you need for investing wisely.

There are a bunch of finance apps from the basic money managers to budget planners to more holistic apps that involve investments. We have rounded up the best for some of the most specific needs that you might consider. You just have to evaluate your lifestyle and your preferences to see which of the apps above you should install on your phone next.