Binance was launched in July 2017 and while it’s still young it managed to become the world’s second largest cryptocurrency exchange. Despite the current bear market, Binance’s growth has continued and the exchange was among the first to reopen user registration during the 2017 bull market’s peak.

The Binance exchange also has its own cryptocurrency with the same name that’s in the top 20 cryptocurrencies by market cap.

Binance’s road to success

So what exactly made Binance the successful exchange it is now? Before anything else, you need to understand how the matching of buy and sell orders works in general since this is one of the main functionalities of an exchange. When an exchange matches buy/sell orders they will not buy and sell your currency themselves. Instead, you will be matched with another user who is willing to buy or sell you the asset at the price you’re asking. Once a match is found and the trade is completed the exchange will charge a transaction fee to both parties.

In theory, order matching is simple, but if the software being used receives more requests than it can handle, this will delay the orders. Since crypto trading is so popular right now, the most popular exchanges are facing millions of trade requests per minute submitted by their users.

Binance has managed to develop a state-of-the-art matching engine that can handle 1.4 million trades per second making their platform one of the fastest currently available. It’s safe to say Binance’s incredibly fast processing speed alone has drawn in many crypto investors.

An exchange must also have liquidity which is defined as the amount and frequency with which assets are moving around the exchange. The order book needs to have a lot of activity to quickly find a match and complete an order at a competitive price. Since Binance’s order book is among the busiest in the world, it’s an excellent choice if you want to perform secure, fast, and competitive transactions.

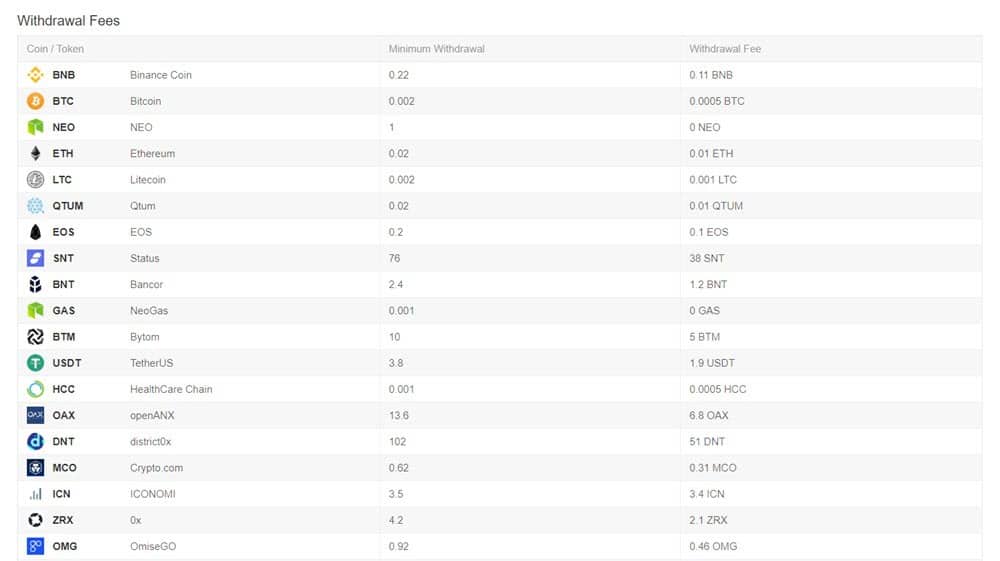

Trading fees are another important aspect of a reliable exchange and Binance has some of the lowest fees. Funding your account is free and the trading fee for orders is just 0.1%. While these fees are competitive as they are, the Binance coin (BNB) allow you to further reduce the trading fees and we’ll get into the details below.

What is Binance coin (BNB)?

Binance was launched along with an ICO for the exchange’s coin. BNB is an ERC20 token built on the Ethereum network with a total supply limited to 200 million BNB.

BNB can be used to pay fees on the Binance exchange and if you’re wondering why you would do that instead of paying the fees using the cryptocurrency you’re exchanging you should know the exchange provides a rebate so users will be motivated to pay their fees in BNB.

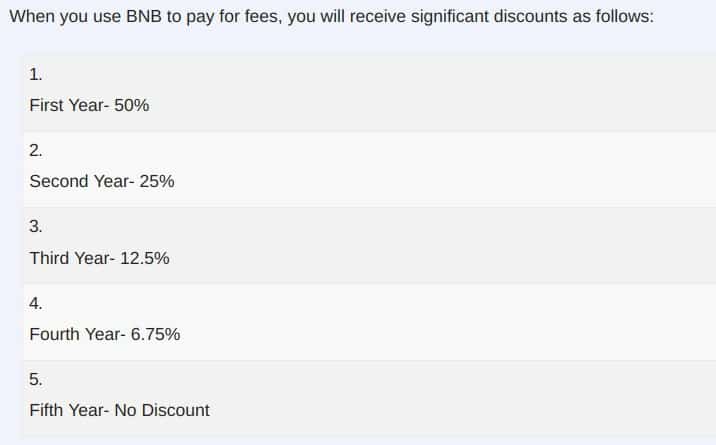

During your first year of membership on Binance, the fees will have a 50% discount when paid in BNB. For each additional year of membership, the fee discount decreases up to the fifth year when there will no longer be a discount for paying fees in BNB.

As the fee discount will decrease every year, the BNB token’s value would also decrease over time. To stabilize the price of their coins, Binance will destroy BNB tokens over time, lowering the total supply of BNB from 200 million to 100 million. This way, the effects of the decreasing discount will be counteracted.

The BNB token can be used for more than getting lower transaction fees on Binance. It can also be used to invest in various ICOs that have joined the Binance Launchpad program. When the ICO ends, the new tokens will be automatically listed on Binance.

The future of the BNB token

Right now, Binance is encouraging users to adopt the BNB token hoping it will keep customers loyal. The fee rebate is a great incentive but as I already mentioned it will decrease over time. However, many users will probably still own some leftover BNB even after reaching their fifth year of membership and they will likely continue to use the token. In the end, the success of the BNB token largely depends on its adoption and that will definitely happen considering Binance is among the world’s top cryptocurrency exchanges.

For now, BNB’s core value is within the exchange but as more investors start using it to get the trading fee rebates, BNB could become a valuable asset. Those who have invested early have already seen a large return so it remains to be seen how many would be willing to hold their BNB tokens hoping the asset will grow.

Assuming Binance will remain on the successful path it currently is on, the exchange will definitely implement additional features and programs and at least some of the new functionalities will use the BNB coin. One example of such a feature is the Binance’s ICO Launchpad program and more will follow.

Binance competition

Binance was the top cryptocurrency exchange worldwide based on trading volume until recently when it was surpassed by the Bitmex exchange which has a trading volume that’s almost three times larger. Nevertheless, Bitmex is an unregulated exchange which also allows margin trading and this is one of the main reasons it managed to outrank Binance in regards to total trading volume.

Where to buy BNB

While there are other exchanges besides Binance that are listing BNB, the liquidity is low which is why the best place to buy it is from Binance itself. It’s also worth mentioning that any coin supported on Binance is available as a trading pair with BNB.

How to store BNB – Wallets

BNB’s potential as a digital asset makes it an interesting long-term investment option. In that case, we suggest you move your BNB tokens off the exchange and into a wallet. Since BNB is an ERC20 token, you can store it in an ERC20 token wallet. For added security, we recommend using a hardware wallet such as the Ledger Nano S, or Trezor.